Forty years is a long time in any industry, however, in the junior mining sector forty years is the equivalent of multiple lifetimes. One of my favorite investors/characters in the junior mining sector is Rob Cudney, a man who has been involved as an investor in the sector since 1980. Mr. Cudney has a colorful personality and an impressive track record as an investor which includes multiple big wins and new discoveries. His forty years of investing experience means that he has more knowledge and experience in his little finger than most investors accumulate in entire lifetimes.

He has literally seen it all.

Just in the last year Cudney saw his stake in Cantex Mine Development (TSX-V:CD) soar to a more than $30 million valuation, only to fully roundtrip back to less than his total cost basis:

CD.V (One Year)

On his Twitter account, Cudney (his Twitter is a must follow if you're a mining investor or horse racing enthusiast) shared some of his optimism and excitement about Cantex last summer when he was actively buying shares on the open market. However, in recent weeks he has turned less optimistic and admitted he may have made a mistake with Cantex management:

At the 2016 PDAC, Cudney and his team won the Bill Dennis Award for the Bruce Channel gold discovery (discovery made by Gold Eagle Mines which was bought by Goldcorp for US$1.5 billion) at the Red Lake gold camp in northwestern Ontario.

Mr. Rob Cudney (2nd from right) receiving the Bill Dennis Award for the Bruce Channel gold discovery at the 2016 PDAC

After chasing him down for a couple of months I finally managed to have an hour long chat with Rob last week. The conversation was insightful and he didn't pull any punches when it came to calling it like he sees it. It's no secret that Cudney is extremely positive on his largest holding, Nighthawk Gold (TSX:NHK), and he also has a soft spot for Copper Reef (CSE:CZC) and Hemlo Explorers (TSX-V:CORE), - he (through his fund Northfield Capital) is the largest shareholder of both CZC and CORE and I know he hopes that one of these two will become his next Gold Eagle (bought by Goldcorp in 2008 for US$1.5 billion) We also discussed what he looks for in a junior mining company before making an investment. He calls it his "pre-flight checklist" which is fitting since he is also a licensed pilot.

Without further ado here is my first ever conversation with legendary junior mining investor Rob Cudney...

Goldfinger: It’s great to talk to you Rob. I think i’ve followed you on Twitter for probably over a year now. And obviously I know about some of your background as an investor in the mining sector. But why don't you fill in our readers on how you got started in the mining sector, how you got your feet wet and what some of your first investments were?

Rob Cudney: All right. So in 1980 as I was going to university, I got a second year summer job working at a brokerage firm, the firm was big into junior mining financing. So I was only there for three months and had no idea about the mining business really whatsoever. And everyone was excited because it was the Hemlo discovery time. So everyone's talking about this new gold camp called Hemlo and I didn't know really looking back, I didn't really know anything. But I knew everyone was excited. It was fun. The stocks were going and trading quite a number of juniors that were in the area. So I thought, "You mean you dig this stuff out of the ground and it's worth money? You can dig it out, wash it off and put it in the bank?" Hemlo is now still going at 20 million ounces plus.

So the next year a friend of mine and I incorporated a company and took it public at 22 cents to sort of start. Our first raise was $300,000 and we started losing money here and there and getting some stocks right, some stocks wrong. It was a $300,000 real bank account rather than just pretending. And so we started doing that and then started following different juniors and I started following different people and getting jobs, working part time with different people like Patrick Sheridan and Don Ross, Murray Pezim, and a number of other guys, Dale Hendrick from Noranda, John Harvey from Noranda.

And it couldn't have been more exciting. Eventually we optioned the property from Kerr Addison and started to drill off the deposit which is still going. It's in a company called Gatling Exploration (TSX-V:GTR), they came back to it, which is one of our 10% holdings. And that's the beginning of just passionate knowledge that I was questioning all these older fellows that are gone now, but in the business and spending time with them. So I didn't have to do anything else after graduation because I knew what I was going to do, which was just work on this, which was not like a job. It was just complete fun all the time. So, that was the start.

Goldfinger: Was there a big win early on that really got you going?

Rob Cudney: There were a number of wins along the way and there were also a number of losses, which I try to forget but through it all we were able to keep our head barely above water. I guess the very first big win that wasn't for at least 10 years after we got started, or I got started. I financed Terry MacGibbon to leave Inco and join one of my junior Shell companies that I was the president of called Fort Knox Gold. We changed the name to FNX Mining and Terry left Inco to run FNX and eventually it went from 25 cents and I believe it hit $39. So I think I was the largest shareholder of FNX and was able to take fairly substantial piece off the table and that gave us our big win, our first fairly large stake to invest in other things.

And then this is not in order, but what's coming to mind is we financed and had a Shell called Southern Star Resources which ended up being Gold Eagle Mines, which I optioned properties in Red Lake from Steve Roman who I'd known for a long time. Gold Eagle we ended up selling in 2008 for US$1.5 billion to Goldcorp. And so that was, I believe our largest win to date was Gold Eagle, FNX is maybe second and we were part of Integra, which was sold to El Dorado. By the way, I'm giving you the good ones. Queenston Mining, we sold to Osisko. From 1982 to 1999 or 2000 we had some modest wins that kept us going. None that are really huge and memorable, but FNX was the first one, Gold Eagle, Queenston and we're involved in quite a number of companies now.

The Bruce Channel Gold Discovery - Gold Eagle Mines is Rob Cudney's biggest win to date (US$1.5 billion buyout by Goldcorp in 2008)

Goldfinger: You've got maybe a half a dozen really big wins in your background based upon what you just said, how many losers or companies that you ended up not really doing well with are there?

Rob Cudney: Not by name, but quite a number of losers, but our stakes, using a modest amount of money, getting FNX going and getting Gold Eagle going and quite a number of other ones and those half a dozen or so big wins, more than made up for probably two dozen ones that didn't work. And I sometimes use the analogy of Ted Williams where you have one player that batted .400 once in the history of the major leagues. If we get anywhere close to .400 it's huge. I'd say we're probably at a normal batting average or good batting average of .300 or .350 and I look at it like out of 10 we might hit one out of the park in a decade, three or four will be reasonably good ones, maybe another three or four that we got our money back and then two or three that are complete losers. So the analogy works for me and I say, I know if we hit one out of the park every decade that we're doing pretty well, that makes up for a lot of losers.

But our group of guys are very dedicated and we try to always improve our averages. And we have quite a number of investments now. So hopefully we do better than the one in a decade. We have four or five that we figured are really good investment opportunities right now.

Goldfinger: Now I've heard you tell me before, you have a checklist like a pilot pre-flight checklist, except it's for mining investments.

Rob Cudney: It’s proprietary.

Goldfinger: Proprietary, well can you give us a little hint on some of the things that you look for?

Rob Cudney: It's nothing that is sophisticated. I'm a pilot so, before you take off you double check the gas. Okay, it's a double check. So management is a double, triple check. The walk around before a flight, you want to make sure you have all the parts working to the best of your knowledge. So the list I might have to stop and reference the list but I'm not going to give it all away. But management is probably the most important thing to check. Project(s) is obviously critical as well, we do a lot of work on projects because we have a 35 year history which allows us to know right away where we don't want to be. I have jurisdictions where I don't like to go and that is one of the criteria is to have a project in a jurisdiction that can be financed. Does it have potential to be an elephant? I mean there's no point chasing mice around and it's just as hard or easy to run a big project as it is a small project.

So I'm using about a 15 to 20 point checklist depending on the name. For instance, the Guyana Goldfields (TSX:GUY) we started in 1994 and I didn't put that on our original six, which was a huge win and it's run into trouble in the last couple of years. But hey, we've revisited going back into it. We were pretty much out of it by 2010 when the market cap went over $1 billion. So that was another seed capital run from 1994.

One of the things we look at is management and the board, the location which was off our grid, except for Patrick Sheridan spent a lot of time working in Guyana. So we did have some expertise in the country, but normally that would be not in our wheelhouse and it's the only English speaking British law country in South America. So we could get along and there was a very good project, which kind of took a little bit of a blind eye to other third world factors. We look at potential upside, we look at capital structure, we looked at, "Is it going to be fun and enjoyable project?" There's no point doing something that you do for the sake of an outcome that may be very, very uncomfortable and life's too short to be in any kind of litigation and so on.

So there brings it back to the management and directors and country. We also look at the motives of the management, whether they're large shareholders or hired or whether we perceive it to be somewhat smoke and mirrors. We really hate bad management and we can't avoid it 100% and we've got sort of a recent case of people not managing things well... You may have very good geologists on board, but it has to be translated through to finance, capital markets and maintaining capital markets - you might have very top notch deals but unable to translate it to brokers and investors on the street. It gets bogged down.

Goldfinger: Are you referring to Cantex (TSX-V:CD)? Because they haven't done a good job on the IR side and with disclosure being rather murky.

Rob Cudney: Well yeah, with IR I take it with a grain of salt. Some have very little gas in the tank and have good IRs so it can work against you with good IR, i.e. a promotion with not such good assets but on the other hand you could have very good product and instead have a hopeless translation to the market. I don't really want to list names but you probably have my names there, the ones that I'm not happy with and then you have to go in and change management, bring other people on and old management resists any change. So there's one or two that have been a bit of a pain in the neck in the last year or so.

Goldfinger: So the most important thing is management in your mind. Project is obviously important but management is more important. You look at share structure, you look at any potential roadblock in terms of litigation or maybe First Nations issues, indigenous issues depending upon which country the project is located. And then obviously valuation has to come into play at some point, right? I mean even if the project has the best management team, the best jurisdiction, the best resource, but if you're paying $1 billion for it, you might lose money. But if you pay $10 million for it, you might make a fortune. Right?

Rob Cudney: Yeah. But we're trying to look for elephants to start with. So if it's in a jurisdiction that's good and in all other respects, but there hasn't been a history of the big one. Now I'll probably get called a liar, or something will come up, but the East coast of Canada's geology is Appalachia, which hasn't come up with a super giant. Now people say, "Oh boy, Voisey's Bay is not really Atlantic Canada, it's Labrador, which is geologically attached to Quebec but now there's obviously like Buchans, Newfoundland has been a huge camp but so far that's the only big one. By and large we stick to Greenstone belt type geologies and that's where our expertise is.

Tony Makuch, CEO of Kirkland Lake Gold (NYSE:KL, TSX:KL) and I used to work together on FNX. I can make a call and be able to download the information from the experience of having to process so many projects over the years. We've stayed away from Nevada, not for any reason other than we don't really have a lot of success there. My expertise is not in Nevada, we picked up a few things, positions in a few different companies and we have actually not had great luck with them. You can tell i'm focused primarily in the heart of Canada; Ontario, Manitoba, and the Northwest Territories, this is my bread and butter.

Goldfinger: Let's talk about the companies that are currently in your portfolio and why don't you choose your three favorites, because I know you've got more than three, but let's choose three and run down the story a little bit and why you own it. What do you think the catalysts are for each company in the next year?

Rob Cudney: Oh, right. Why don't we start with number one. Nighthawk Gold.

We put Nighthawk together by merging a couple of companies and financed it. We backed Dr. Mike Byron, and we put together a good board of directors. So management was mostly internal from our group of other companies and longterm shareholders or familiar shareholders, familiar management, this new project and then so we got the management, we've got the board of directors that I have very good representation with most of them, are historically we've worked with most of the directors in the past. Good track record and Mike Byron has been involved in Lake Shore Gold and other things that have been successful. We have an Osisko director on board that built Malartic. Luc Lessard was actually the guy that built the biggest gold mine in Canada. He's on the Nighthawk board and then the geology had to be good. The pockets had to be good.

Nighthawk is in a Greenstone belt, which is what we're familiar with. It's very under explored and it's a huge package the size of Kirkland Lake and Timmons and put together and there's nine or 10 historical deposits that haven't been fully explored. A little bit of production in the 90s and the property being 60 kilometers long and 25 to 35 kilometers wide. Colomac right now being the flagship, which was a small producer in the 90s but it's opened up tremendously at depth and along strike, so we believe we're talking 3 to 3.5 kilometers of strike. This is my back of the napkin math which is not 43-101 obviously, but I don't go by 43-101, I go by our own math.

The rocks are very similar to Kalgoorlie in Australia, which is the biggest open pit gold mine in the world. 60 kilometers long as they said, 25 kilometers wide. The Colomac seal itself is mineralized in very strongly over three, three and a half kilometers now. The unexplored part is another three kilometers, so seven kilometers in total, which also fits in with the size of Kalgoorlie. I'm running my numbers at two kilometers, which is conservative, I believe 50 meters wide and thickness and a thousand meters depth. Our deepest hole to date I believe is about 800 meters and it's widening and widening, getting wider and wider. It's up to a hundred plus meters wide, so we don't expect it to close down in the next few hundred years and in fact I expect it to keep going to 1,500-2,000 meters. I put myself, in my own internal numbers, I put 1.8 grams on the whole thing (1.8 grams/tonne gold average project grade). But there's some very good sweet spots. For example, there's a hole off the top of my head comes in at 56 meters of 13.5 grams per tonne gold.

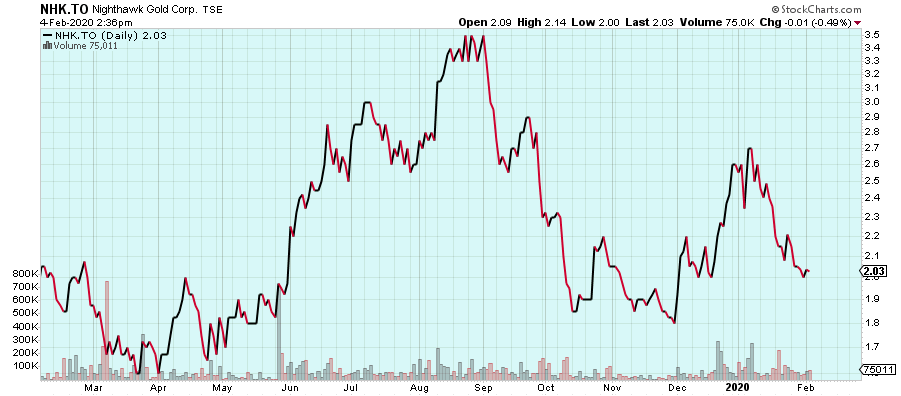

NHK.TO (Daily - One Year)

Goldfinger: Wow! 56 meters of 13.5 grams per tonne gold. That’s quite a hole.

Rob Cudney: That's 13 and a half grams, 56 meters. We believe that 60% of that would be true width, so that would be about 34 meters. When you get these kinds of sweeteners, then that will bring the overall grade up. When there's a bad gold market, you can concentrate on mining the high-grade areas, gold goes way up and you could mine the lower grade.

Goldfinger: It’s definitely a world class intercept. It's a world class project, there's no doubt about it. Just a question about a couple of challenges for Nighthawk. The location is isolated and there is no infrastructure. How much is the capex going to be to get this built? Any permitting or First Nations challenges?

Rob Cudney: It’s less than 200 kilometers from Yellowknife (the territorial capital of The Northwest Territories), there is also a power dam under a hundred kilometers from the project. Roads are actually being built now and it's going more quickly than we originally thought. So infrastructure, if you find something big enough anywhere in the world infrastructure will come to you. For example, in the 1920s Noranda was found in mid range Quebec, Val-d'Or and Noranda, Quebec, which were not even serviced by railway then. Once Ed Horne found the deposit, there were two railways competing. Now Nighthawk is not overly challenged. It's not that far off the main road, not that far from power. It's not that far from skilled people. I don't find that Nighthawk is one of those locations that is challenged. Really not so much at all.

Now there's other projects I've been involved in and currently involved with that are much more remote than that. We've got a great government in the Northwest territories. Mine friendly and I'm looking to make this one of the world class mines. I see it. The feasibility study will bring in that financing, we have many of the same people onboard that helped build Victoria Gold's Eagle Gold Mine, same people. Those companies are able to limit the amount of dilution because for instance, Caterpillar comes in with equipment, the banks and private equity that are financing you don't have to find that $300 million out of selling equity. I can see having this thing all fully operational with somewhere in the neighborhood of $75 million in equity raised over the next three years, but this will actually be producing gold at the end of that three years.

Goldfinger: That's a relatively small CAPEX. I thought the CAPEX would be a lot larger than that.

Rob Cudney: You don't need to, we're getting to the point where we're getting confident of the deposit. The exploration drilling is adding reserves and confidence. But we've kind of come across, that's why we rolled it back now because we're ready for... We've hired JDS for scoping, which I do think will come out positive. Hopefully all of that metallurgy, scoping, engineering, and start with an open pit that's very high grade which would payback the capex quickly. So you're tracking on a new ground, but very educated projections. Trying to take the surprises out of it. At some point we would bring in, chairs would be lined up for people trying to put the debt on board to build the mine. And the other thing is with Nighthawk, both Osisko and Kinross own 10% of the company. So you've got to draw on their expertise. We have an Osisko director and a director from Kinross.

I think Nighthawk is on its way to being a major and maybe we won't even last until we get the project built. Gold Eagle I sold to Goldcorp for a billion and a half dollars and we were about two weeks into starting to sink the shaft when we got the offer. The collar was just being built. The highest plate just arrived on site and Goldcorp decided it needed to have it. Now we're always letting companies take a look. But in the meantime we're going to build the project. Steady progress will be made every month. We're only about six, seven weeks away from the next drill program to start. So we haven't even finished all the results from this year. And then we're going to be announcing we're moving into camp to start drilling again.

Goldfinger: That's a great update on Nighthawk. What’s the next company in your stable?

Rob Cudney: Well, I've recently taken a controlling position in a company called Copper Reef (CSE:CZC) that we had looked at 10 years ago and were very unhappy with management. So we did not go ahead, recently we've changed the management and the drill program is beginning. This is a major drill program and Copper Reef is the second largest land owner after Hudbay in Saskatchewan and Manitoba. Again, Greenstone rocks, geology that we're familiar with and we've beefed up the management and Northfield is running the finances and so on. So we're going to put a big effort on exploration there.

Goldfinger: Copper Reef checks all your boxes then?

Rob Cudney: Checks most of the boxes. Now one of our major projects is we bought all the most all juniors land positions in what's called the Ring of Fire and that company is going to remain private until... We're starting the drill program and so on in the next month. But I was involved in financing the original discovery of the Ring of Fire, in fact I named it Ring of Fire. Because of all kinds of factors, infrastructure, now that's the challenge. Nighthawk is not a challenge. The Ring of Fire is a challenge. We expect some announcements very soon on roads and infrastructure coming in. We expect it to be one of the biggest mining camps in the world. The Ring of Fire is a similar scalability to the Sudbury camp.

John Harvey who was running the Juno subsidiary Northfield capital is the award winner for discovering the Ring of Fire. So we're putting the team from 2006 back together. We expect to go public with it within a year, but we're probably your audience is not going to want to pay too much attention because it is private still. Now we have another company that we're rolling by and recapitalizing which was Canadian Orebodies. We had an unfortunate of accident losing our CEO last summer, Gordon McKinnon. And we've announced the rollback and a change of name we expect to be drilling. It's the second largest land owner in the whole Hemlo camp. Gordon's father discovered Hemlo. We have it in our office. We have the board, we have control of finances and we're working the project towards drilling.

We don't think that it will be drill ready until September. We have field work to do until then, so that again is Canadian Orebodies, which will have its name changed in a number of weeks. It's been announced that it will be called Hemlo explorers and again we have John Harvey running the program who was president of Hemlo Gold and president of Noranda Exploration earlier in his career. So we put together the right people, number one again all comes back to that scalability of a project and putting all the ingredients in to bake the cake. Now we have a number of other projects, but you wanted to keep it to three.

Goldfinger: With Hemlo Explorers (TSX-V:CORE) the company has a very big land package in the Hemlo region and there has been some work done on these properties. But as you said, there's more work that needs to be done to identify the drill targets.

Rob Cudney: Drill targets are not finalized until this season's work is underway. We know where we think we're going here but it needs more work to precisely locate the targets. We're zooming in on them but they're not finalized yet. I might expect that won't be for about another six months. But it's important to emphasize that CORE's projects are right in the middle of infrastructure and we can drill year round. So when we start is not seasonal, we can just start then go.

Goldfinger: You can drill year round and CORE’s projects are located in a prolific mining region of Ontario. Frankly, the stock is dirt cheap and I don’t think it will require a whole lot to see a 100% or 200% gain from current levels (C$.10 per share).

Rob Cudney: And our founder of CORE who happened to have gotten killed in an accident last summer, Gord McKinnon, whose office is beside mine. His father, Don McKinnon, was the man credited with the discovery. And so we were able to use a lot of old files and put this land package together, which is second to none in the camp. The Hemlo Camp is very under explored and most of all the juniors from the rush when I started in the business have been gone, absorbed or out of business.

So Nighthawk is the Indin Lake camp, which is Yellowknife, Juno is the Ring of Fire, Hemlo Explorers in the Hemlo camp and we've been involved with Queenston, which is Kirkland Lake. We sold, Agnico now owns it and Gold Eagle and the Red Lake camp. So we're talking multi-million ounce camps in the gold business. So there's an old saying about being in the shadow of a head frame so we like that as far as project locations go. And then we like to stay away from outside investments as much as we can and in the last few years we have decided to just generate our own internally.

Goldfinger: One final question I guess or maybe two, two more questions. So the first one would be like with Hemlo Explorers, obviously the Hemlo discovery was a big deal in the 80s and got a lot of attention and probably all that area got staked at one point. How do you come across highly prospective projects that have already had multiple owners and some work has been done on them? How does that slip through the cracks to where you're able to make a new discovery? Like for example, in Red Lake, the Dixie project had multiple owners over the past 15 years and then Great Bear and Bob Singh came along with a new interpretation and they're hitting gold with almost every drill hole. How does that happen, that discoveries are simply overlooked? It's amazing that a project like a Dixie was just sitting there for so long even as other operators drilled on the property, but they had the wrong geological model.

Rob Cudney: Yeah. I was in an early financing for Great Bear. Hemlo had a small deposit on it for 75 years. Let me take you back to Malartic, Quebec. The old mine was shut down since the 60s, and Osisko did a new interpretation on the whole thing and now it's the largest gold producer in Canada, a different model. And that's right next door to Agnico and the other gold companies, I mean right in the neighborhood and they missed it. So there's lots of life left in these old camps. I don't really know the history of drilling at Great Bear's Dixie Project. I know a little bit about it, but there's another expression about mines being made, not found. I mean there was smoke at Dixie and they followed up on that. You won't find anything without the drill going. My group of investing in companies is trying to do 150,000 meters across the board this year.

That's the way the Dixies are found (Great Bear’s Dixie Project in the Red Lake District of Ontario). They're the Great Bear or the Malartic or Osiskos, or the Nighthawk. Big camps, big upside, big elephant hunting. You need to have good sized property positions. So once you do find something you hopefully have the claims around it staked. We follow Great Bear and it just shows that these camps have a lot more life left in them. Kirkland Lake, Macassa was just about near it's end and now it's got a new shaft going in, a huge new life for Kirkland Lake Gold.

Goldfinger: Rob, what advice would you give to a relatively new investor to the junior mining sector? What tips do you think would serve somebody well, who's just trying to get their feet wet in the sector?

Rob Cudney: Well, I'll go back to my checklist which is fairly straightforward. There's not many tricks to my checklist, which is management, a history of the project camp, jurisdiction, financial backing, scalability. As far as you want to go elephant hunting, I mean there's no point finding projects that have the history of the camp aren't scalable and there's many great mines, but you want to be where you can build a big project... If you go elephant hunting, you'd go to Africa. And then it's key to research management - what is management's track record? It's not hard to do the work on the history of directors, when you see a company that might catch your eye to run through the history of the people at the helm. Really cheap and easy to do from day one.

Goldfinger: So for a new investor you say management is most important. I mean first of all I talk to them and second of all I look at their track record, their bio. Is there anything else that you think is important in terms of identifying and figuring out if management is good?

Rob Cudney: It's so important. It's hard for me to underrate checking that out at the very beginning. Why go into something where management has a not so good track record? It's worth investment groups and clubs and so on to put that at the top of their list. I don't see any other better advice to small investors.

Goldfinger: And what about management ownership?

Rob Cudney: Well, ownership. Sponsorship is important as well. I'd like to say that we're good sponsors now, but we insist on being... Even recently we've had mistakes and I'm trying to eliminate mistakes that are obviously in retrospect, 20-20 hindsight. I should've known better as far as making these mistakes and you try to eliminate the mistakes. You might want to have a portfolio of half a dozen juniors that management checks out. Management, don't forget will find good projects. There's a lot to this management thing. Presumably good management knows where to go hunting. Like a good hunter knows, a good fisherman knows the best holes. So does that make sense to you?

Goldfinger: Yes, it makes sense. Thank you for your time and insights, I really enjoyed this chat and I wish you many 10-baggers in this new mining bull market!

Dislosure: Author owns shares of CORE.V and may choose to buy or sell at any time without notice.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.